Bitcoin has seen a plummet of just about 7% at this time as on-chain information exhibits the miners have continued to use their promoting stress.

Bitcoin Miner Reserve Has Continued To Head Down Lately

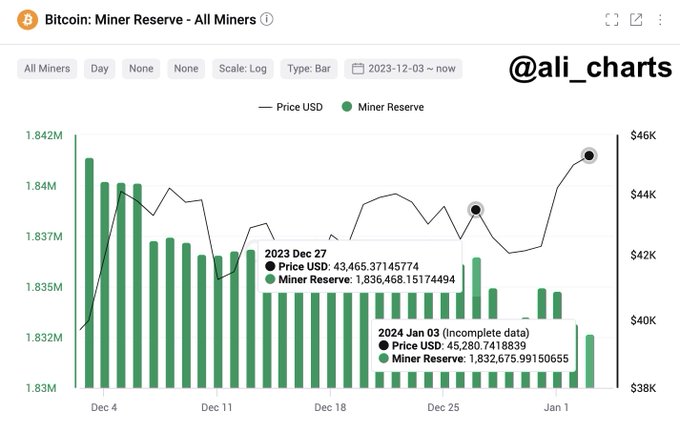

As identified by analyst Ali in a brand new put up on X, the BTC miners have made some hefty promoting strikes over the last 10 days. The indicator of curiosity right here is the “miner reserve,” which retains observe of the entire quantity of Bitcoin the miners are carrying of their wallets.

When the worth of this metric goes down, it implies that these chain validators are presently transferring their cash out of their addresses. Usually, one of many principal causes miners would resolve to withdraw is for promoting functions, so this type of development can have a bearish influence on BTC.

Then again, the indicator rising in worth implies this cohort is presently receiving a internet variety of cash in its wallets. Such a development could also be an indication that the miners are accumulating, which may have bullish implications for the worth in the long run.

Now, here’s a chart that exhibits the development within the Bitcoin miner reserve over the previous month:

From the chart, it’s seen that the Bitcoin miner reserve has seen an total downtrend through the previous 10 days or so. This lower within the metric may probably be an indication that these chain validators have been making use of promoting stress in the marketplace.

At first, the miners had been promoting as BTC dropped from above the $43,000 stage in direction of the lows seen earlier than the latest rally. As soon as BTC hit the lows, although, some miners determined to make use of the chance to build up, because the reserve noticed some rise.

After Bitcoin noticed its sharp rally in direction of the $45,000 stage, although, these chain validators as soon as once more made promoting strikes, because the indicator resumed its downwards trajectory. In whole, miners have offered BTC value $176 million on this interval.

The analyst had shared the chart simply earlier than BTC’s crash at this time, during which the cryptocurrency has now declined into the $42,000 ranges. Given the timing, it’s potential the newest profit-taking strikes from the miners might have been an element.

Nonetheless, any contribution (if any in any respect) from these strikes in direction of the plunge would solely be slight, as the quantity that miners have probably offered isn’t an excessive amount of within the grand scheme of issues.

The on-chain analytics agency CryptoQuant may need identified a more likely supply of the promoting stress behind the crash in an X put up.

As displayed within the chart, the imply quantity of Bitcoin flowing into exchanges (extra exactly, its 7-day easy shifting common) has simply risen to a 45-month excessive.

This could suggest that a lot of the inflows going to exchanges are very giant in worth, a typical signal of whale exercise. This promoting stress from the whales, which is of ranges not witnessed for the reason that COVID crash again in March 2020, may certainly clarify the worth plunge.

BTC Value

On the time of writing, Bitcoin is buying and selling round $42,400, down 2% prior to now week.