On-chain information reveals the Bitcoin change inflows have remained low not too long ago, an indication that the whales have been disinterested in promoting.

Bitcoin Inflows For Binance & OKX Have Stayed Low Just lately

As identified by CryptoQuant founder and CEO Ki Younger Ju in a submit on X, the BTC deposits for cryptocurrency exchanges Binance and OKX have been low not too long ago.

The on-chain indicator of curiosity right here is the “change influx,” which retains monitor of the overall quantity of Bitcoin that’s being transferred to the wallets hooked up to centralized exchanges.

When the worth of this metric is excessive, it implies that the buyers are depositing a lot of tokens to those platforms proper now. As one of many principal the reason why holders would switch to the exchanges is for selling-purposes, this type of pattern can have bearish implications for the asset.

Alternatively, the indicator being low implies these platforms aren’t observing that many deposits at present. Relying on the pattern within the reverse metric, the change outflow, such a price could also be both bullish or impartial for the cryptocurrency’s worth.

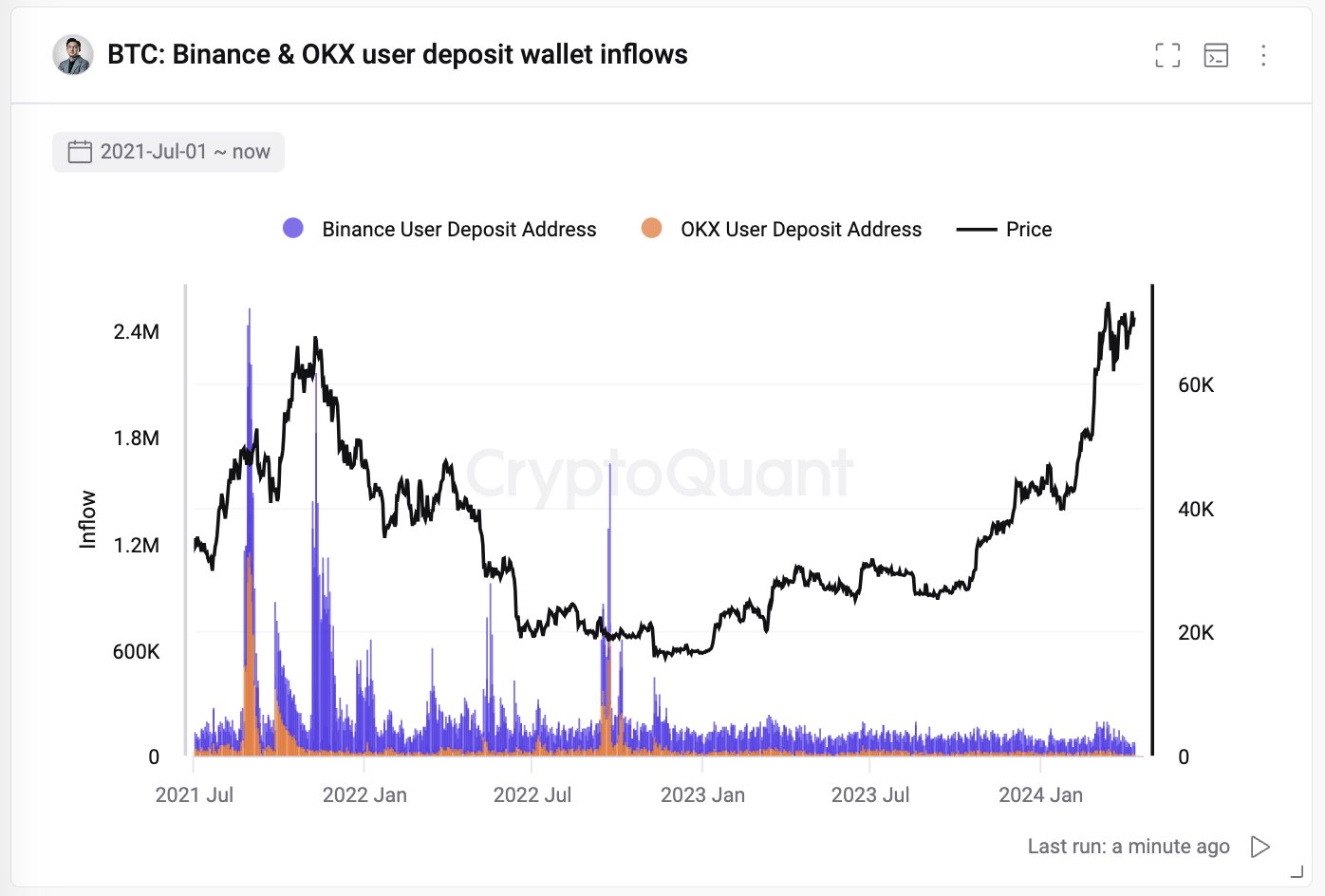

Now, here’s a chart that reveals the pattern within the Bitcoin change influx for Binance and OKX over the previous few years:

Binance is the biggest change on the planet on the premise of buying and selling quantity, whereas OKX is usually quantity two behind it in the identical metric. Whereas these two platforms actually don’t make up for your entire cryptocurrency market, the person habits on them would nonetheless present an estimation concerning the wider sample.

As is seen within the chart, the change influx for Binance and OKX has been at comparatively low ranges for fairly some time now. When BTC noticed its rally in the direction of a brand new all-time excessive (ATH) earlier within the yr, the deposits noticed a slight uptrend, however not too long ago, the inflows slumped again to low values.

This could recommend that the urge for food for promoting, significantly from the whales, simply hasn’t been there for the cryptocurrency. Even the ATH break might solely entice a couple of massive customers of the platforms to push in the direction of promoting.

The habits is in distinction to, for instance, the second half of the 2021 bull run, which will be seen within the chart. The rally again then had not solely noticed some distinctive influx spikes, however the baseline inflows had additionally usually been increased than latest ranges.

Curiously, the 2 main tops of the rally had additionally coincided fairly properly with extraordinarily massive inflows, so going by this sample, the present rally is probably not close to a high but.

Although, it stays to be seen whether or not this similar pattern would proceed to carry for this cycle, given the contemporary emergence of the spot exchange-traded funds (ETFs).

The ETFs have offered an alternate means to achieve publicity to the asset, which means that cryptocurrency exchanges could not carry the identical relevance out there anymore.

BTC Value

On the time of writing, Bitcoin is floating round $70,400, up greater than 5% over the past seven days.