On-chain knowledge reveals the stablecoin market cap has returned to optimistic development not too long ago, which could be bullish for Bitcoin.

Stablecoin Market Cap Has Lastly Flipped On 30-Day Change

As defined by CryptoQuant founder and CEO Ki Younger Ju in a brand new put up on X, the stablecoin market cap has set a brand new all-time excessive (ATH) following the renewal of the uptrend.

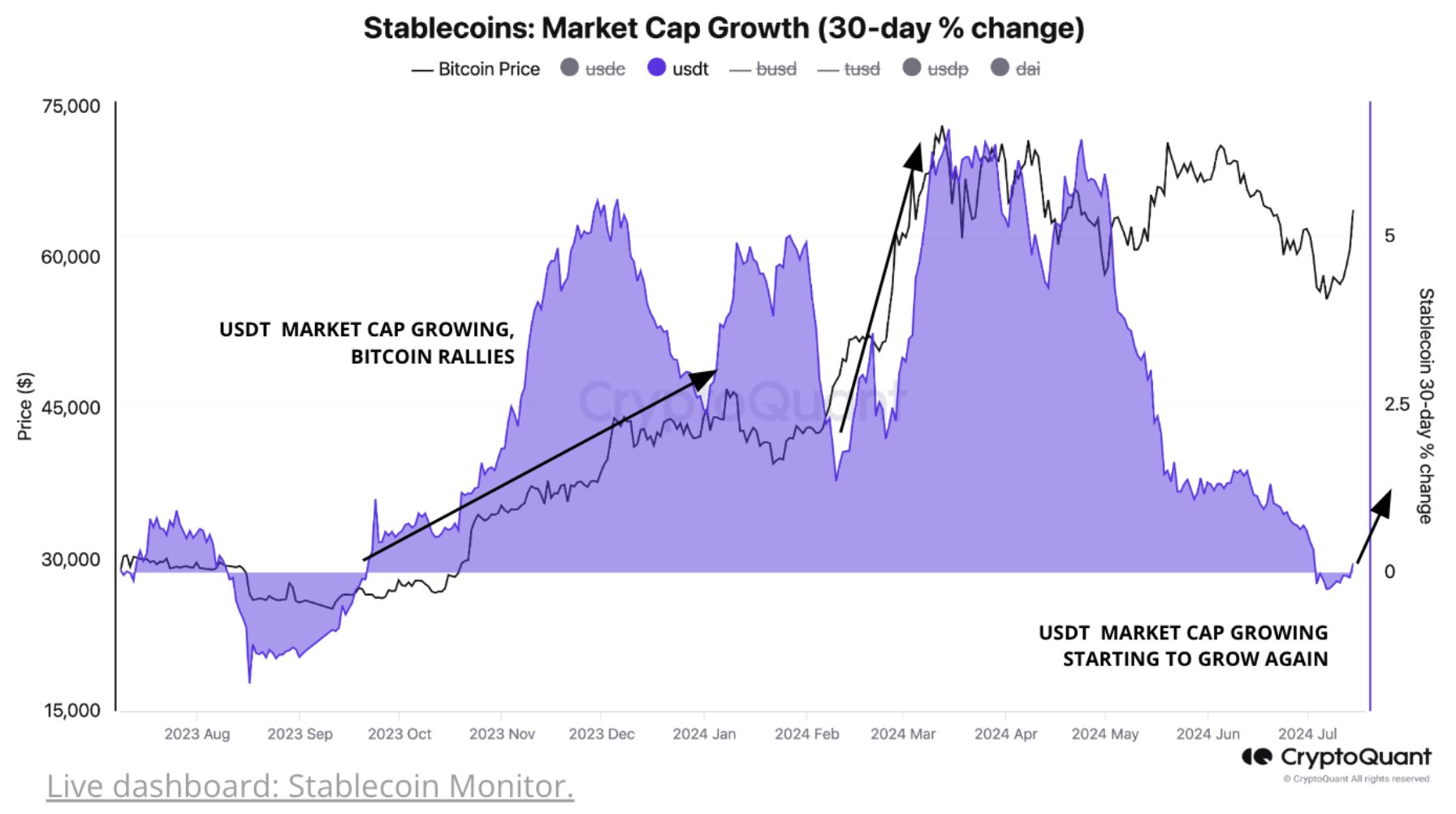

Under is the chart shared by Younger Ju that reveals the pattern within the 30-day proportion change for the market cap of the most important stablecoin within the sector, Tether (USDT), over the previous yr:

As is seen within the above graph, the 30-day proportion change out there cap of USDT had turned destructive earlier, implying that the full valuation of the stablecoin had been shrinking.

The decline didn’t final for too lengthy, although, because the metric has not too long ago flipped again into the optimistic area. The surge above zero is barely slight, that means the potential turnaround has simply began.

Traditionally, an increase out there cap of stablecoins has been a bullish signal for Bitcoin. Within the chart, the analyst highlighted how this sample adopted in the course of the previous yr.

To grasp why the stables relate to Bitcoin, their position out there should first be examined. Usually, traders retailer their capital in these fiat-tied tokens to keep away from the volatility related to different cryptocurrencies.

Nonetheless, holders who hold their capital like this normally plan to dip again into the unstable facet. As such, the market cap of the stablecoins can, in a manner, characterize the accessible shopping for energy for cash like Bitcoin. Due to this fact, when this metric rises, so does the dry powder accessible for BTC and others.

The most recent reversal within the Tether market cap has come as BTC itself has proven a pointy restoration surge, suggesting that the rise within the stablecoins has come as a consequence of recent capital inflows quite than a rotation of capital from the primary cryptocurrency.

This can be an particularly bullish combo, because it means that not solely is their capital sitting on the sidelines ready to be deployed into Bitcoin, however BTC itself has additionally seen direct capital inflows.

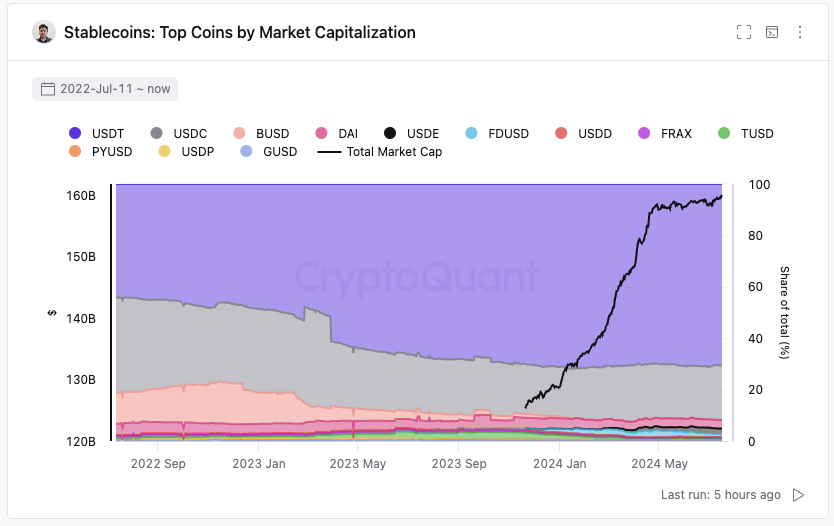

Following the most recent improve, Tether now occupies round 70% of the full stablecoin market cap, because the chart under shows.

As can also be obvious from the graph, the full stablecoin market cap has set a brand new document following the return of capital inflows.

Bitcoin Worth

On the time of writing, Bitcoin is buying and selling at round $63,700, up greater than 10% over the previous week.