Bitcoin has noticed a rally past the $71,000 degree in the course of the previous day as on-chain information reveals demand for the coin has notably elevated.

Bitcoin Obvious Demand Has Spiked To Notable Constructive Ranges Just lately

As an analyst in a CryptoQuant Quicktake put up defined, the demand for Bitcoin has seemed to be on the rise once more just lately. The on-chain metric of curiosity right here is the “Obvious Demand,” which retains observe of the distinction between the BTC manufacturing and the adjustments in its stock.

The one option to produce BTC is by including new blocks to the chain and receiving block subsidy as compensation, so the asset’s manufacturing is equated to the quantity that the miners are getting in rewards on daily basis, generally known as the Issuance.

BTC’s ‘stock’ will be thought of a part of its circulating provide, which has been sitting nonetheless for greater than a yr. Thus, the adjustments within the stock can be the online variety of tokens maturing into or exiting out of this group.

Now, here’s a chart that reveals the pattern within the Bitcoin Obvious Demand because the begin of the yr 2024:

As displayed within the above graph, the Bitcoin Obvious Demand had slumped to ranges across the impartial mark in the course of the earlier part of consolidation that the asset had gone by means of. Nonetheless, just lately, its worth has surged to notable optimistic ranges.

After the rise, the indicator has reached the identical excessive as in February of this yr. From the chart, it’s seen that what adopted again then was BTC’s rally to a brand new all-time excessive (ATH).

To date, the latest burst of demand has additionally accompanied a recent rally within the cryptocurrency’s value, which has taken the asset above the $72,000 degree. Given the pattern that occurred within the first quarter of the yr, it’s attainable that BTC might take pleasure in additional upside if the Obvious Demand continues its development.

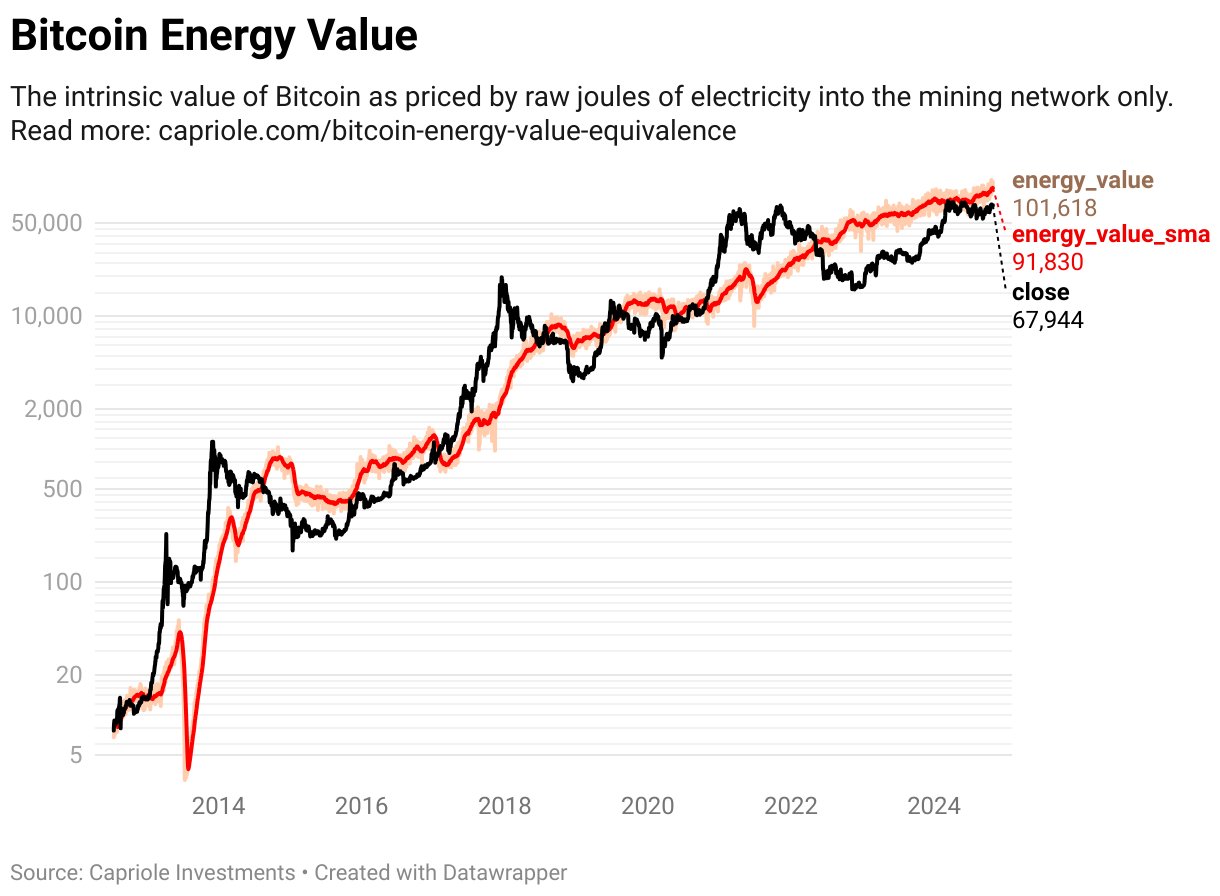

In different information, the Bitcoin Vitality Worth has just lately crossed the $100,000 degree, as Capriole Investments founder Charles Edwards defined in an X put up.

The “Vitality Worth” right here refers to a mannequin for the cryptocurrency that calculates its honest worth as a perform of the quantity of power (measured in Joules) spent to provide it. The power right here is of course the one miners use to energy their computing machines with, to carry out the duty of BTC mining.

Right here is the chart for the metric shared by the analyst:

The graph reveals that that is the primary time that the Bitcoin Vitality Worth has damaged past this degree.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $72,400, up nearly 8% over the previous week.